MaxEn’s services include:

Capital raising for independent power projects using alternative and alternative alternative fuels and acquisition of companies with development and production opportunities;

Formation of investment funds using structures aimed at 100% principal protection, but with returns above investment grade;

Arranging financing through outside emerging market development sources, both equity and debt financing, for energy infrastructure development and industrial expansion;

Bridge equity for emerging companies and capital for acquisition of public companies with undervalued assets, which are available for sale to third parties.

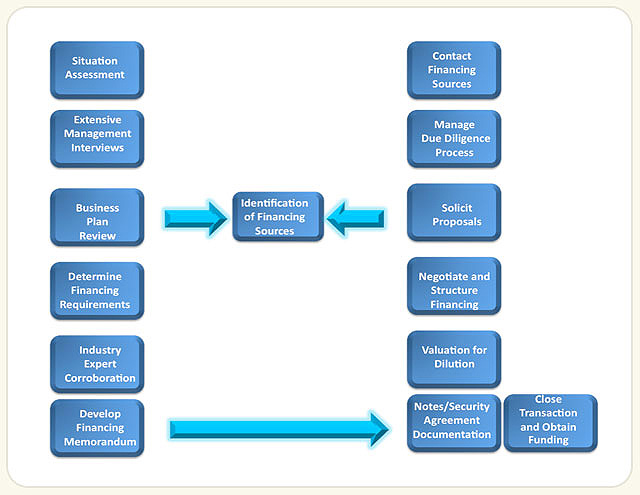

In addition we offer stand-alone consulting services in all areas of the financing process as set out in the following table:

|

|

Project Finance Process

MaxEn takes a highly disciplined approach to all of our funding activities. This means we leave no stone unturned. Our clients benefit from the results.